This article was originally produced in conjunction with Boring Money for their Investment Trust Hub.

Some information contained herein has been obtained from third party sources and has not been independently verified by Polar Capital. Neither Polar Capital nor any other party involved makes any express or implied warranties or representations.

The financials sector is a vital component of the global economy. Encompassing banks, insurance companies, asset management firms, and fintech, financials stocks collectively make and shape markets around the world. However, despite the dynamism and versatility of this sector, the legacy of the Global Financial Crisis (GFC) almost two decades ago casts a long shadow over investors’ perception. Will 2025 at last be the year to shed old concerns and cash in on financials’ fresh potential?

Financials overtake global markets in 2024

The financials sector has proven its resilience in recent years. In the midst of a turbulent economic landscape marred by a global pandemic, rocketing inflation, and the disruptive effect of a new generation of artificial intelligence, many financial firms have faced an uphill battle to maintain performance. However, returns have generally been positive, with the global financials benchmark generating double digit returns across 2024 to date.

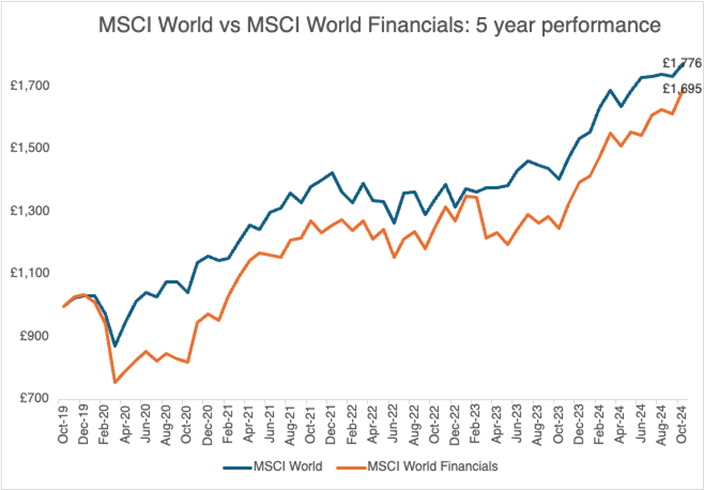

The MSCI World Financials Index (USD), widely regarded as one of the foremost indicators of the performance of the global financials sector, has generated 5-year returns of +11.73%.1 This index tracks large and mid-cap financials stocks across 23 developed markets. Its performance lags only slightly behind the global market index, MSCI World Index (USD), which recorded +12.57% returns over the same period.2

However, in the last twelve months, financials have gathered steam and overtaken global markets by quite some margin – MSCI Financials posted +43.82% returns compared to +33.68% from MSCI World.3 This recent outperformance compounds even further when we look at the last 3 months, where financials generated returns of +5.26% against +2.45% from MSCI World.4

The graph below shows the performance of a single £1,000 investment in both the MSCI World and MSCI Financials from October 2019 – October 2024 – note the steep increase between August – October 2024.

|

Source: FE FundAnalytics. Correct as at November 2024.

Interest rate projections spell favourable position for financials

So what’s putting the wind in the sails of financials stocks this year? Tom Dorner, Fund Manager at the Polar Capital Global Financials Trust – an investment trust which focuses on identifying “the best investment opportunities across the world of financials” - thinks much of it can be attributed to inflation, interest rates, and the likelihood that central banks will sustain higher rates for a while yet.5,6

“Following Covid and a period of rampant inflation, we have entered a period of what we consider to be more normal policy,” Dorner explains. “While interest rates have started to decline from recent elevated levels, they are likely to settle far above where they have been for the past 10+ years”.

Indeed, despite the headline narrative of rampant inflation being wrangled back down to earth in 2024, the Bank of England’s November Monetary Policy Report forecast UK inflation to rise to 2.75% - above the target 2% - over the next year. And while economists had polled a 65% chance of another base rate cut in December, odds have shrunk slightly since then, indicating a growing belief that the Bank will keep rates higher for longer.7

A forecast by Vanguard UK concedes: “A return to ultra-low interest rates is unlikely. By the end of 2025, we expect policy rates to be between 2.25% and 3.75% across major developed markets. We’re not returning to a zero-interest rate world anytime soon, and this will have profound implications for the global economy and financial markets. [...] This higher interest rate environment will last not months, but years”.8

But how do higher interest rates, or at least a pause in plans to cut them, stand to benefit financials stocks? Michael Wong, Director of Financial Services Equity Research at Morningstar, explains how rates have a far-reaching impact on all corners of the sector, from the more obvious areas such as bank profits to the asset management firms running funds and other investment products.9

“Interest-rate-related revenue is a core part of the earnings stream or the business of many financial services companies. [...] Banks are the most obvious. They receive interest on their loans and also on the fixed-income securities and mortgage-backed or other asset-backed securities that they hold on their balance sheet when they have more deposits than they can find profitable opportunities to loan out for. Then they also have it as part of their core operations, like the interest they pay on their deposits”.

Beyond the banks, higher rates typically also spell good news for insurance companies. “People who follow Warren Buffett and Berkshire Hathaway know that insurance companies make money from investing the float in the time between when they collect those premiums and when they pay out,” Wong adds. “So, insurance companies are heavily influenced by the return that they gain on their investment portfolio, which is determined largely by interest rates”.

And further still, interest rates can also impact the profit margin for asset management firms, which are able to hike fees for money market funds – a type of fund which invests in very low-risk investments, such as cash and government bonds (themselves directly impacted by interest rates). “In a zero-interest-rate environment, the company has to waive a lot of fees. But once interest rates start coming back, it will have a material uplift in revenue”.

Beyond the banks, higher rates typically also spell good news for insurance companies.

Of course, there’s no predicting the future, and interest rates over the course of 2025 are hardly set in stone. We’ve already seen a “bigger-than-expected” jump in UK inflation data in November 2024, driven by higher energy prices, and concerns are mounting that aggressive tariffs under a new Trump presidency could push US inflation up and put his administration at odds with the Federal Reserve’s existing plans for rate cuts.10,11

Add to this the very real risk of escalating geopolitical tensions, which could in turn shake markets and take the momentum out of financials’ recent bullishness, and it’s not hard to see why the path ahead is not exactly crystal clear.

Investors ditching growth-focused tech stocks for value

Despite the uncertainty around interest rate policy from the major banks, a transition is taking place in investors’ preferences which could represent more certain, longer-term prospects for financials; There are signs that value investing, at long last, is back.

In recent years, growth stocks (companies expected to increase in value faster than the market or its industry peers) have been exceedingly popular. Think the buzz around AI and the seemingly universal fascination with the “Magnificent Seven” tech stocks - Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta Platforms (Facebook) and Tesla. These firms have dominated headlines and have helped to drive record returns for some of the biggest indices in the world.

Value stocks – those that are currently trading at a lower price lower than their actual intrinsic value – have largely been left behind when it comes to what’s been piquing investors’ interest. These are firms that “tend to do well when the entire economy grows” and financials (banks in particular) are commonly touted as examples of value stocks.12

There are signs that the lustre of the growth strategy is beginning to lose its shine. Investors withdrew a whopping $6.91 billion from growth funds in the first week of September, marking the largest weekly outflow since December 2023.13 Analysts at Morningstar say investors are increasingly “turning their focus from big tech toward less-loved areas that may benefit from a new interest rate regime and a steadily growing economy”.14

This point is corroborated by industry experts, such as at Raintree Wealth Management, where their analysts believe growth stocks are ripe for a resurgence in popularity: “While growth investing will always have its place in the market, the current economic and market conditions suggest that value investing is becoming more attractive again. Rising interest rates, market rotation, inflation concerns, and the historical tendency to reverse the mean indicate a favourable environment for value stocks”.15

John Rekenthaler, Vice President of Research at Morningstar, says that the appeal of value stocks – though having fallen into the shadow of glitzy growth stocks in recent years - is ultimately evergreen:

“Per the academic research, buying stocks on the cheap has flourished for as long as the data has existed. Why? The common explanation is sentiment. What is now unloved will later receive its due. True enough. Value investing certainly does benefit when the unpopular becomes popular”.16

In an October article, the team behind Polar Capital Global Financials Trust emphasized that financials have outperformed other value sectors over the last few years and suggest financials stocks could provide a great opportunity for investors to incorporate value into their portfolio without compromising on performance:17

“Not only do we think financials are a good way to diversify away from growth exposures, we also believe the sector offers the best way among value-oriented sectors to do so”.

Actively managed funds with exposure to the financials sector, such as the Polar Capital Global Financials Trust, aim to stringently select stocks with the best potential – and retain the agility to rebalance or adjust the portfolio according to market movements.

The experts at Professional Wealth Management agree, adding that they expect value investing to ultimately trump growth in the coming years. However, they also caution investors not to put all the eggs in the cheapest basket in the name of “value investing”:

“We don’t believe investors should take a dogmatic approach to value investing and pile into the cheapest quartile of stocks with expectation of mean reversion. This approach misses structural change – where stocks are cheap because they are being out-competed, or worse permanently impaired, by their competition. Just as it’s critical to avoid growth traps, such as Microsoft and co in 1999, it’s also critical to avoid value traps. A more pragmatic approach to value investing, where investors focus on paying the right price for a company’s business resilience and growth profile, will help avoid the classic value traps”.18

This is where active management becomes especially appealing for the investors who are keen to get a slice of the value pie. Passively putting all your money in the cheapest stocks, or simply opting to track one of the indices, may not produce the results you’re looking for. Or even worse, it could leave you unduly exposed if any one of those stocks underperforms or tanks altogether.

Actively managed funds with exposure to the financials sector, such as the Polar Capital Global Financials Trust, aim to stringently select stocks with the best potential – and retain the agility to rebalance or adjust the portfolio according to market movements.

The forecast for financials in 2025

So as we close off the year and prepare for the start of 2025, the experts are broadly in agreement that the financials sector is likely to continue on its recent outperformance trajectory, offering a blend of resilience and growth opportunities – so long as there are no big shocks along the way.

Favourable interest rate projections and the continued rotation toward value stocks suggest that financials will remain an attractive option for investors in 2025. However, there will be challenges too – sticky inflation and geopolitical risks (particularly in the wake of a Trump victory in the US Election) mean that careful consideration when investing in the financials sector is essential.

José Ramón Díez, Head of International Economics & Markets at CaixaBank Research, lists what he sees as the main obstacles for the sector in the year ahead: “The risk menu is well known to all: intensification of tariff conflicts; escalation of geopolitical risk, with a focus on the Middle East and Ukraine, affecting commodity prices; problems in the last mile of inflation, and increased financial instability”.19

How this will all play out, and to what extent these concerns will impact the performance of financials stocks, is impossible to predict at this stage. However, for fund managers in the sector, the mood music for 2025 is optimistic – perhaps more so than in other market sectors at this time. Polar Capital’s Dorner harks back to the words of famed investor Warren Buffet:20

“Investor sentiment and positioning towards the sector reflects a negative legacy perception, rather than the new reality which is much more favourable. We believe that Warren Buffet’s ‘Be greedy when others are fearful’ comment is as relevant now as it was when he first used it nearly 40 years ago and we think the fact that markets remain fearful of financials is a fantastic opportunity for investors”.

[5] Polar Capital, November 2024

[6] Polar Capital, October 2024

[8] Vanguard UK, December 2023

[9] Morningstar, November 2022

[15] Raintree Wealth Management, August 2024

[17] Polar Capital, October 2024

[18] Professional Wealth Management, October 2024