"I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful." Warren Buffett

Since the global financial crisis (GFC), a sustained period of ‘abnormal’ monetary policy1 by historic standards, featuring extensive quantitative easing2 and extremely low interest rates, has had a profound impact on leadership in equity markets. High-growth sectors performed strongly and equity investors became relatively less valuation-sensitive. This was a challenging environment for some financials, particularly banks which found it hard to deliver attractive returns on equity. One might say that for the longest time, investors became greedy for growth.

Following Covid and a period of rampant inflation, we have entered a period of what we consider to be more normal policy. While interest rates have started to decline from recent elevated levels, they are likely to settle far above where they have been for the past 10+ years and it looks like we are heading for a soft economic landing. In this environment, we think equity market leadership will change and financials are well positioned to outperform as returns on equity remain much better than they have been for most of the post-GFC period.

This has only just started to be reflected in the relative outperformance of financials. Investor sentiment and positioning towards the sector reflects a negative legacy perception, rather than the new reality which is much more favourable.

We believe that Warren Buffet’s ‘Be greedy when others are fearful’ comment is as relevant now as it was when he first used it nearly 40 years ago3 and we think the fact that markets remain fearful of financials is a fantastic opportunity for investors.

Markets have been greedy for growth

The Bank of America Global Fund Manager survey contains an interesting chronology of the most ‘crowded’ trades in global equities. For most of the time since 2018, equity investors have seen the Magnificent Seven and US technology more generally as the most crowded trade. The reality is that this consensual positioning has been very successful – these equities have performed strongly. However, the consequence of this performance has led to a concentration in global equities that we suspect is underappreciated by clients and the recent explosion in artificial intelligence has further amplified this.

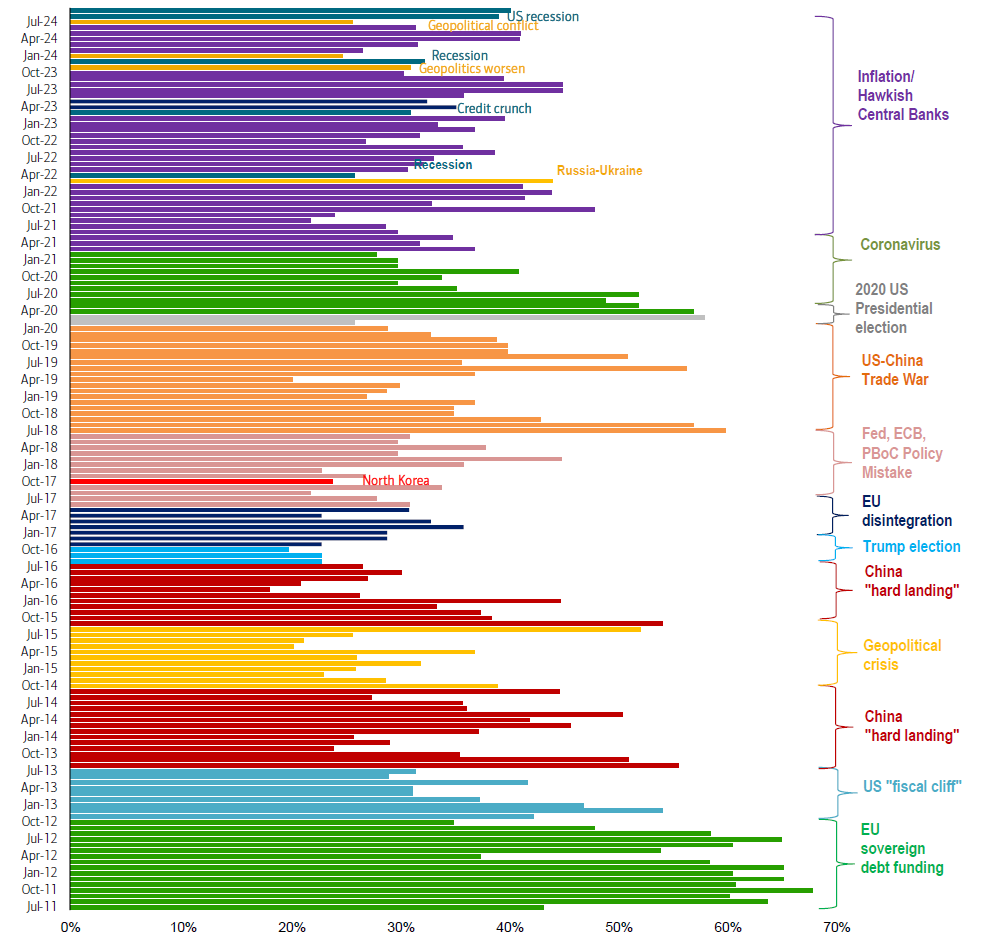

| History of Global FMS 'biggest tail risk' answers |

|

| Source: BofA Global Fund Manager Survey. |

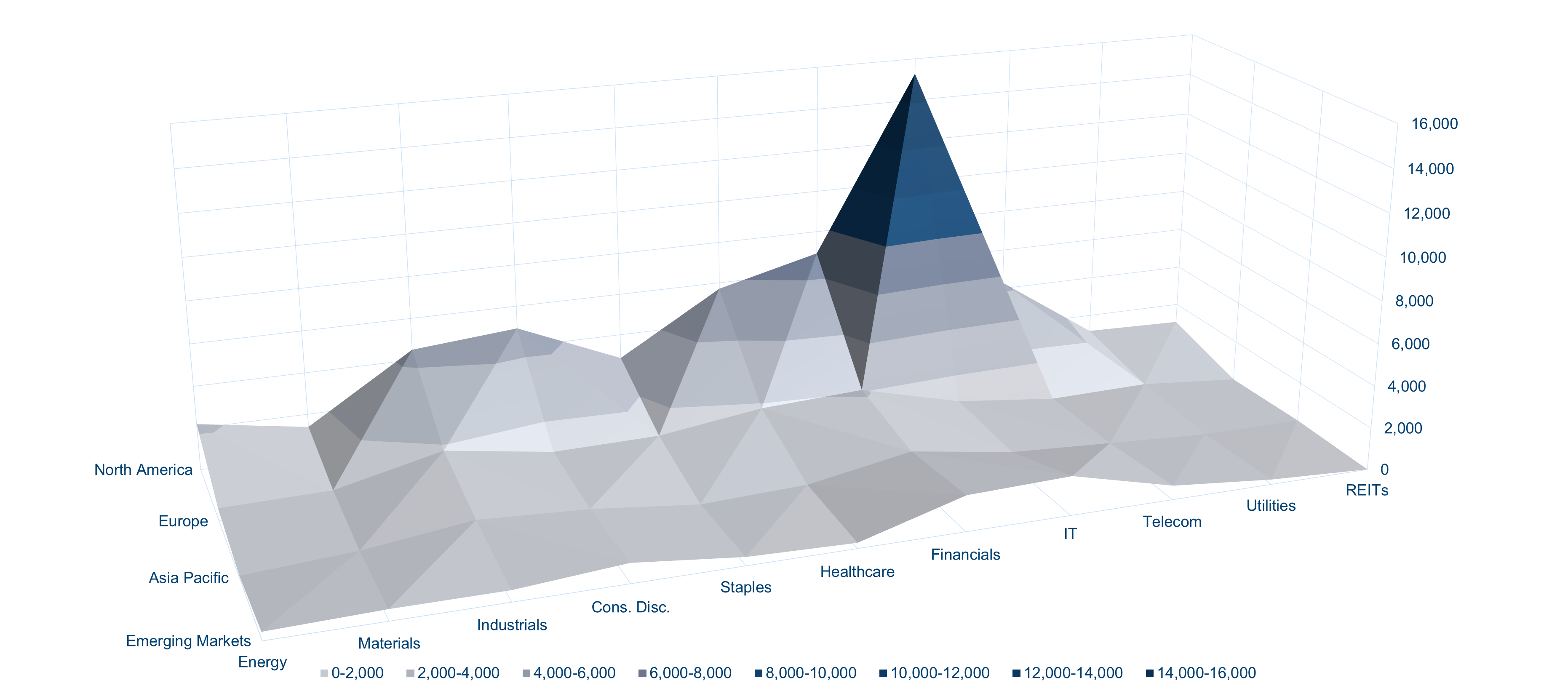

The chart below shows a topographical breakdown of the global equity market – the higher the ‘mountain’, the more global market cap is concentrated in this part of the market. This is a visually compelling way to represent the extreme concentration in the US technology sector, which currently accounts for c25% of global equities. Whether clients are invested in global equity, US equity or thematic equity funds, it is quite likely that they are more overweight this theme than they appreciate.

‘Topographical’ breakdown of global equities by sector and region |

|

| Source: Polar Capital, MSCI, Bank of America, July 2024. |

We think it makes sense for clients to diversify away from this singular theme and believe financials are best placed to benefit from a rotation away from growth sectors. There are already signs this is starting to happen.

Markets are fearful of financials…

We find that much of the investor debate on financials is fearful and tends to be narrowly focused on banks. It is therefore worth taking a step back to consider the financials sector in a broader context.

First, it is hard to ignore how economically significant the sector is given it oversees >$400trn assets across various subsectors4.

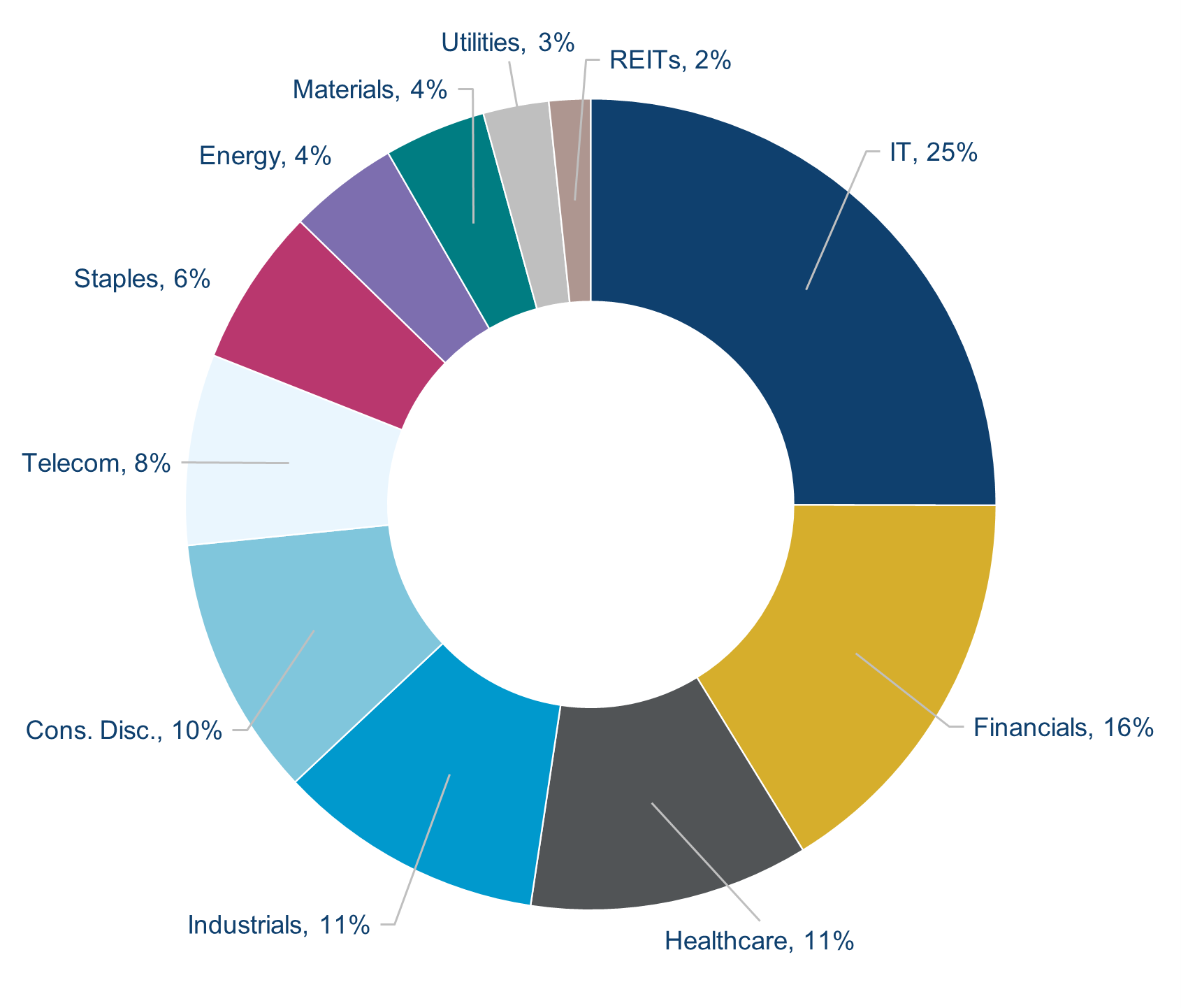

Second, financials are important for equity investors because it is the second largest sector in global equities (see the pie chart below). Therefore, the consensual investor underweight positioning exposes clients to potential benchmark risk which is a much smaller consideration for other more value-oriented sectors such as energy or utilities.

Third, the pie chart below also shows the sector is surprisingly diverse, across banking (c40%), insurance (c20%), diversified financials (c30%) and payments (c10%). Each of these subsectors has distinct drivers and offers compelling idiosyncratic stock opportunities for us to take advantage of as active managers.

Composition of Global Equities and Global Financials | |

|  |

| Source: MSCI, September 2024. | |

...but markets are also showing signs of change

There are signs that leadership in the equity market is starting to change as financials are starting to outperform the wider market. Over one and three years, financials have outperformed the broader MSCI All Country World Index by 4%. The sector has also outperformed other value sectors during the same period. Not only do we think financials are a good way to diversify away from growth exposures, we also believe the sector offers the best way among value-oriented sectors to do so.

Financials relative to global equity markets and value indices |

|

| Source: Polar Capital, Bloomberg, to 31 July 2024. |

There have been many drivers of this outperformance including (1) a sharp normalisation in interest rates which has supported net interest incomes5 and investment incomes across the sector, (2) a very favourable backdrop for pricing in the reinsurance and commercial insurance markets, and (3) the continuation of various structural trends including growth in private markets, data and payments. We think that these factors should continue to support the sector for the coming years.

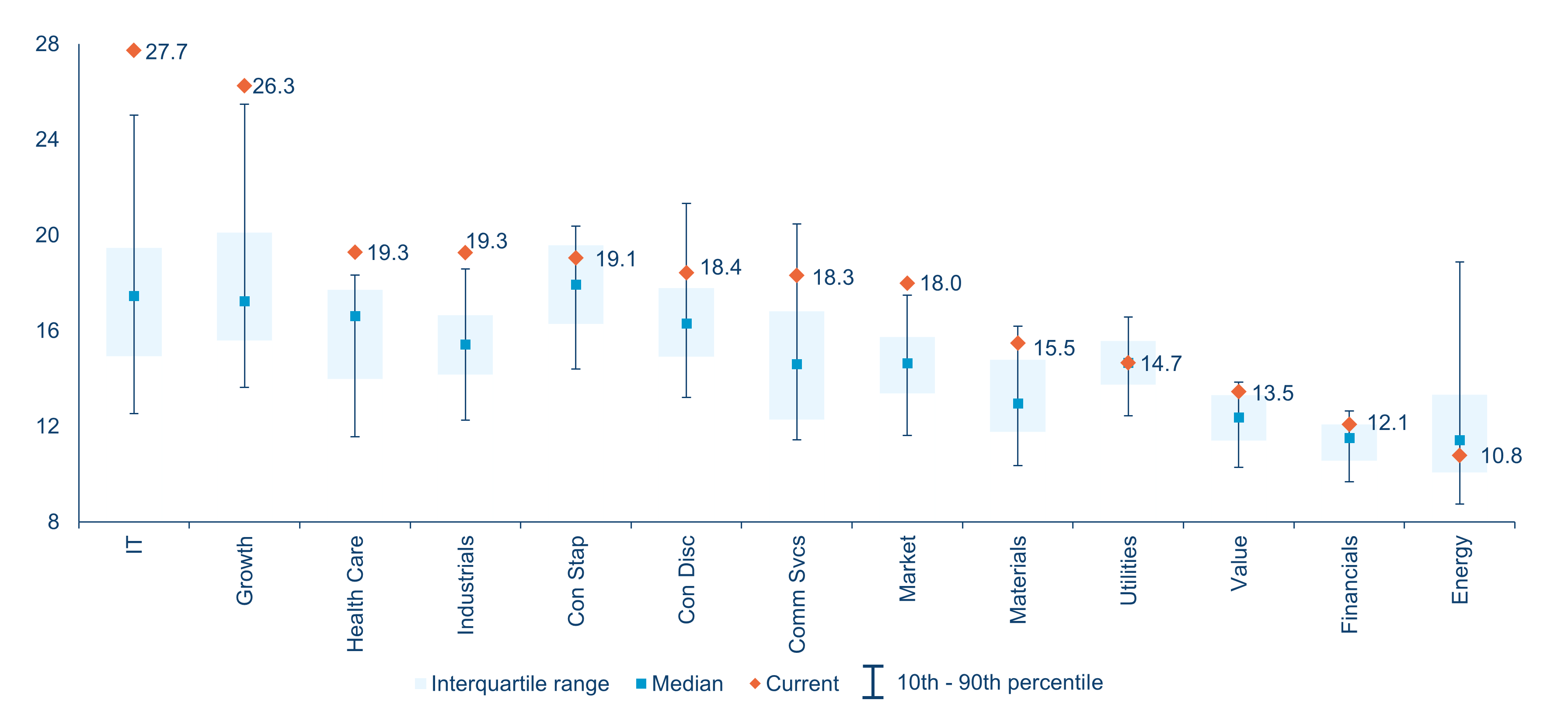

Valuations for financials remain compelling

Despite good relative performance in recent years, financials continue to be very attractively valued. Price/earnings (P/E)6 valuations are at the higher end of their historical range but remain at a significant discount compared with most other sectors in the market. This is particularly the case compared with IT and growth sectors in general where valuations look extreme by historical standards. We believe this provides compelling evidence that there remains strong valuation support for considering financials as a way to diversify exposures in clients’ portfolios.

MSCI World sector/style valuation, 12-month forward P/Es relative to the past 20 years |

|

| Source: FactSet, Datastream, Goldman Sachs Global Investment Research, 19 July 2024. |

Conclusions: time to turn greedy for financials

We think it is time for investors to turn greedy for financials rather than being fearful. The market still sees the sector with a degree of negative muscle memory, which misses its strong operating trends in recent years and underappreciates the diversity of the sector. Financials have been outperforming the wider market, but it is not too late because valuations remain very attractive. Given the degree of concentration in equity markets, we also think financials can help clients diversify their overweight exposures towards extended growth sectors.

1. Monetary policy is action that a country's central bank or government can take to influence how much money is in the economy and how much it costs to borrow

2. Quantitative easing (QE) is used by central banks whereby they buy securities to reduce interest rates, increase the supply of money and encourage more lending to consumers and businesses

3. Chairman's Letter - 1986 (berkshirehathaway.com)

4. McKinsey

5. Net interest income (NII) is the difference between revenues generated by a bank's interest-paying assets and the cost of paying out interest

6. A company's share price related to its earnings per share